OVERVIEW

European High Yield

High yield bonds are debt securities issued by companies with a rating below triple B. Such sector (and especially the B-BB segment) represents in Europe the rating class of the vast majority of industrial companies. The steady growth of this market in the last years is mainly attributable to the progressive use of capital markets as a way to finance companies and, considering the disintermediation process arose from the implementation of Basel 3, it is reasonable to say that this sector will continue to grow significantly during the next years.

The considerable growth of the European high yield market (ex-financial, namely excluding securities issued by financial institutions) during the last years, allowed this market to be considered as an asset class in its own right, now included in the portfolio of the main institutional investors.

Download reporting:

- VER CAPITAL CREDIT FUND, May 2025

- VER CAPITAL HIGH YIELD ITALIAN SELECTION, May 2025

- VER CAPITAL SHORT TERM (VCST), May 202

Download funds' NAV:

Morningstar Link:

Class B (Institutional) – Class D (Retail)

VER CAPITAL CREDIT Ver Capital Credit Fund

- Class BX: https://www.morningstar.it/it/funds/snapshot/snapshot.aspx?id=F00001N0OE

- Class BY: https://www.morningstar.it/it/funds/snapshot/snapshot.aspx?id=F00001N0OD

- Class DX: https://www.morningstar.it/it/funds/snapshot/snapshot.aspx?id=F00001N0OF

- Class DY: https://www.morningstar.it/it/funds/snapshot/snapshot.aspx?id=F00001N0OG

VER CAPITAL CREDIT VALUE Ver Capital High Yield Italian Selection

- Class BX: https://morningstar.it/it/funds/snapshot/snapshot.aspx?id=F00001N0OI

- Class DX: https://www.morningstar.it/it/funds/snapshot/snapshot.aspx?id=F00001N0OH

LUX IM Ver Capital Short Term

- Class DX: https://www.morningstar.it/it/funds/snapshot/snapshot.aspx?id=F00001AM5P

- Class DY: https://www.morningstar.it/it/funds/snapshot/snapshot.aspx?id=F00001AM6F

Link for all information related to LUX IM Ver Capital Short Term:

https://www.bgfml.lu/site/en/home/products/lux-im/ver-capital-short-term.html

European Leveraged Loan

Corporate loans are often referred to as leveraged loans when initially associated with leveraged buy-out operations. They are floating rate instruments with a reward given by Euribor plus a spread which is the expression of the credit risk of the issuer.

Senior secured loans, English Law, LMA (Loan Market Association), are considered the safer assets within the sector and are typically characterized by:

- High degree of information rights (at the outset: information memorandum, business/fiscal/legal/financial due diligence; overtime: monthly and/or quarterly reports, and most importantly, forward looking information, including business plans);

- High contractual protection and control rights (contractual covenants checked on a quarterly basis);

- Security package. The Collateral typically includes tangible and intangible assets of the borrower and share pledge;

- Voting rights aimed to protect minorities .

The loan secondary market has grown and is more and more structured, with indexes, dedicated platforms (i.e. Markit) and daily quotations from all the main investment banks.

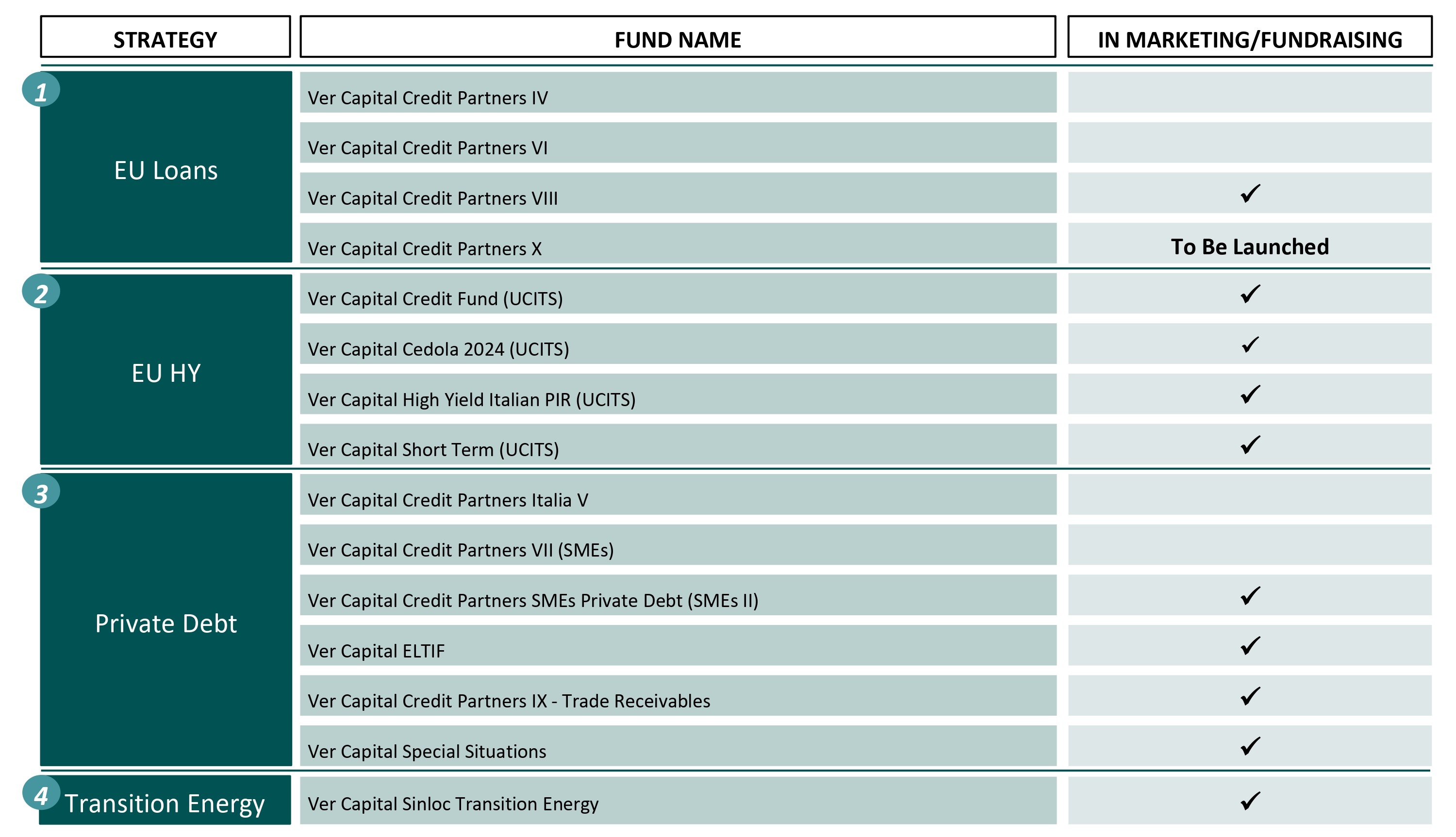

Funds managed by Ver Capital mainly investing in European corporate loans:

- Ver Capital Credit Partners VIII (Open-ended and monthly liquidity)

- Ver Capital Credit Partners VI

- Ver Capital Credit Partners IV

Private Debt

Along with European high yield and European corporate loans, Ver Capital is active from 2006 in the Italian private debt market.

The development of the Italian private debt market has reached new highs in recent times, both in terms of size and in terms of innovation of the instruments. Recent evolutions of the regulation have simplified the bond issuance procedures for non-listed SMEs, aligning the financing opportunities of the Italian companies to those of the more advanced European industrial and financial systems.

Funds managed by Ver Capital mainly investing in local private debt:

- Ver Capital Credit Opportunity FUND

- Ver Capital Credit Partners Italia V

- Ver Capital Credit Partners SMEs VII

- Ver Capital Credit Partners SMEs Private Debt (SMEs II)

- Ver Capital Credit Partners IX - Trade Receivables

SPECIAL SIT

Ver Capital, alongside its traditional strategies, has flanked a new fund to assist Italian companies in a situation of temporary stress but with adequate profitability prospects. The main focus of the fund is on Italian corporates with more than €50 million of sales and with one or more of the following features:

• Excessive debt and/or

• Liquidity constraints and/or

• Operation and business restructuring needs and/or

• Potential for management improvement and/or

• In an insolvency procedure such as recovery plans, restructuring agreements and negotiated compositions.

Other key characteristics of the fund are:

• New money only

• Mainly super senior financing with a full governance control

• Hands on approach

• Investment period: 5 years

• Target size: €300 million

• Fund final maturity: 2033

• Medium-term investment horizon (3-4 years)

• Target number of investments: 10-12

TRANSITION ENERGY

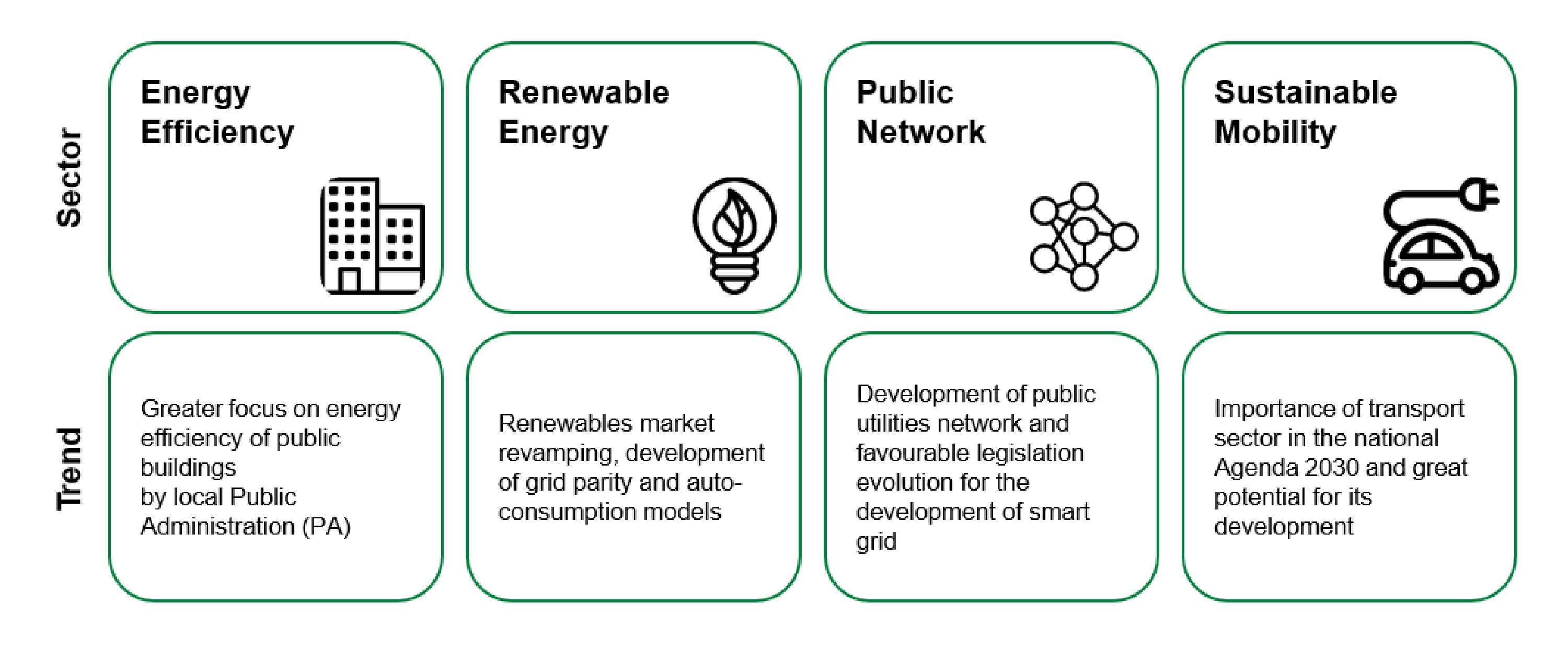

The Fund "Ver Capital Sinloc Transition Energy Fund - TEF" is a closed-end AIF under Italian law managed by Ver Capital with the technical support of the advisor Sinloc. Ver Capital and Sinloc have formed an operational partnership through the integration of Sinloc's expertise and experience in the development of energy efficiency and renewable energy projects and Ver Capital's experience in optimising the financial structures of the companies and projects in which it invests.

The purpose of the Fund, classified Art. 9 according to EU Regulation 2019/2088 SFDR, is the generation of positive impacts through its investments. The investment strategy is in line with the SGD targets and is based on ESG criteria pre-established within the Fund's prospectus and monitored on an ongoing basis.

The Fund may make investments in "target companies" that develop

-

energy efficiency;

-

renewable energy installations;

-

public networks;

-

sustainable mobility projects.

The minimum impact targets and their application methodology to define a suitable investment have been verified and appraised by the Energy Strategy Group of the Politecnico di Milano University.

These targets refer to parameters consistent with the mission of the energy transition and are expressed in units of measurement useful for reporting the non-financial results achieved in terms of reduction of non-renewable primary energy consumption (TOE) and reduction of climate-changing emissions (CO2).

The Fund's investment strategy envisages the possibility of investing

-

at least 50% of the Fund's amount in late Greenfield projects (late greenfield projects means projects which are in the ready to build phase with all the licenses already granted).

-

up to 50% in Brownfield projects (projects with a cash flow history and no construction phase risks).

The Fund's management team is composed of professionals with multi-disciplinary profiles and a high average seniority; the team has a consolidated and diversified track record in the research, selection, structuring and management of investment transactions in assets consistent with the Fund's investment strategy, combining significant financial returns with positive and measurable environmental and social impacts over time.

The Fund is currently in both the investment and fundraising phases. In fact, after completing the first closing in September 2023, it has already made the first two investments and is building the pipeline for the entire fund.

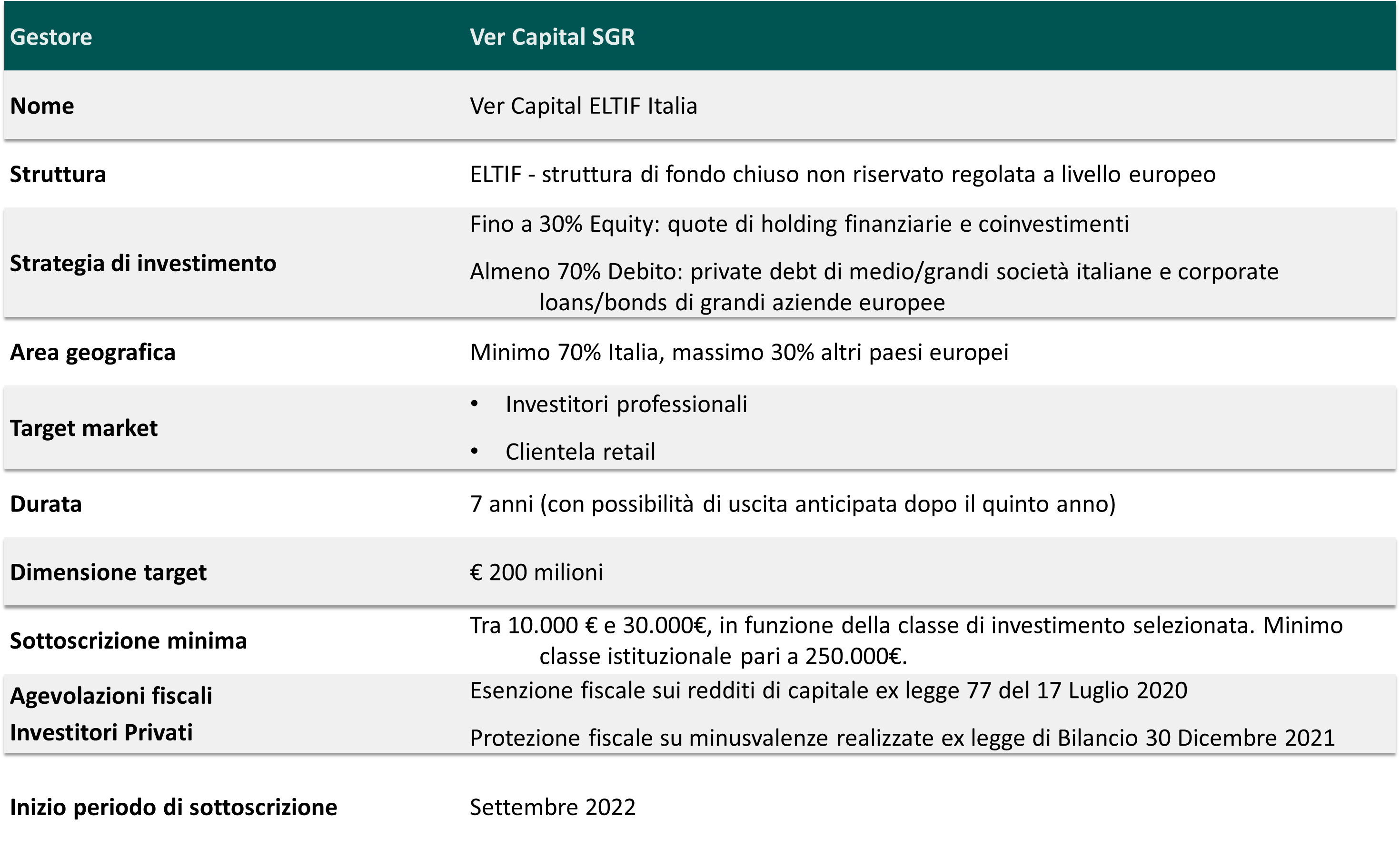

Ver Capital ELTIF Italia

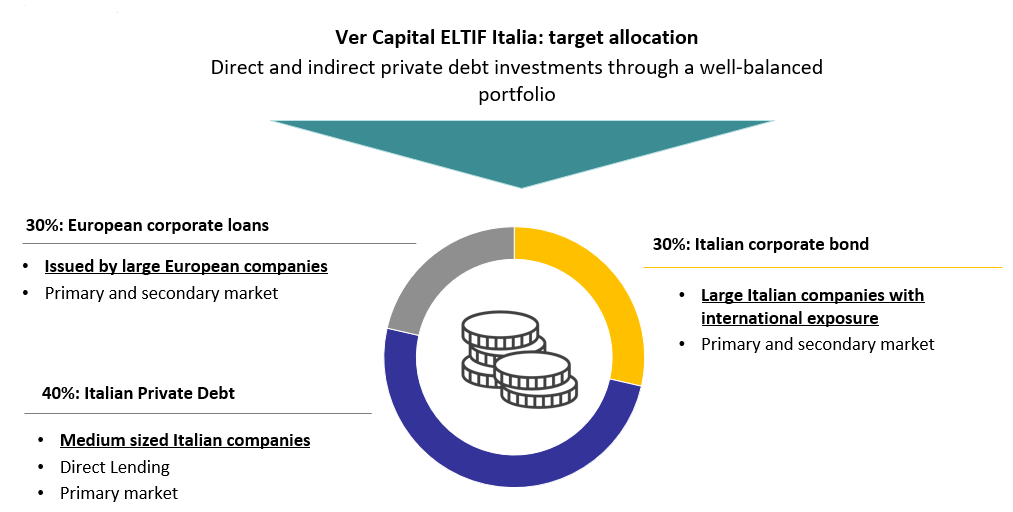

Ver Capital ELTIF Italia is a closed-end Eltif Fund - Alternative PIR - which invests in the most competitive Italian and European medium and large industrial companies, with the objective of achieving double digits returns. The fund also offers retail investors the unique opportunity to access the European Private Debt asset class, otherwise reserved only to institutional investors.

As a PIR compliant fund, it invests at least 70% of its resources in Italian companies and up to 30% in European companies, with the following asset allocation:

• 40% Italian Private Debt

• 30%: European corporate loans

• 30%: Italian corporate bonds

VER CAPITAL ELTIF ITALIA, being compliant with the PIR regulation, offers investors access to the following generous tax advantages:

- Complete tax exemption on capital gain and on proceeds distributions

- Exemption from inheritance taxes

All this translates into a very interesting expected return for investors, offering:

- An expected gross annual return of more than 10%

- Minimum subscription starting from € 10.000,00 (10 thousand euro)

Features

Documents

- Amministrazione e Marketing

Regolamento Ver Capital ELTIF Italia

Prospetto Ver Capital ELTIF Italia

- Avvisi

Avviso commercializzazione 18 03 2024

Avviso ai sottoscrittori 18 03 2024

Avviso commercializzazione 19-09-22

Avviso II periodo di sottoscrizione

Avviso Prolungamento II Periodo di sottoscrizione

- KIID

KID Classe A Ver Capital ELTIF Italia

KID Classe A1 Ver Capital ELTIF Italia

KID Classe B Ver Capital ELTIF Italia

KID Classe B1 Ver Capital ELTIF Italia

COLLOCATORS