Our Principles

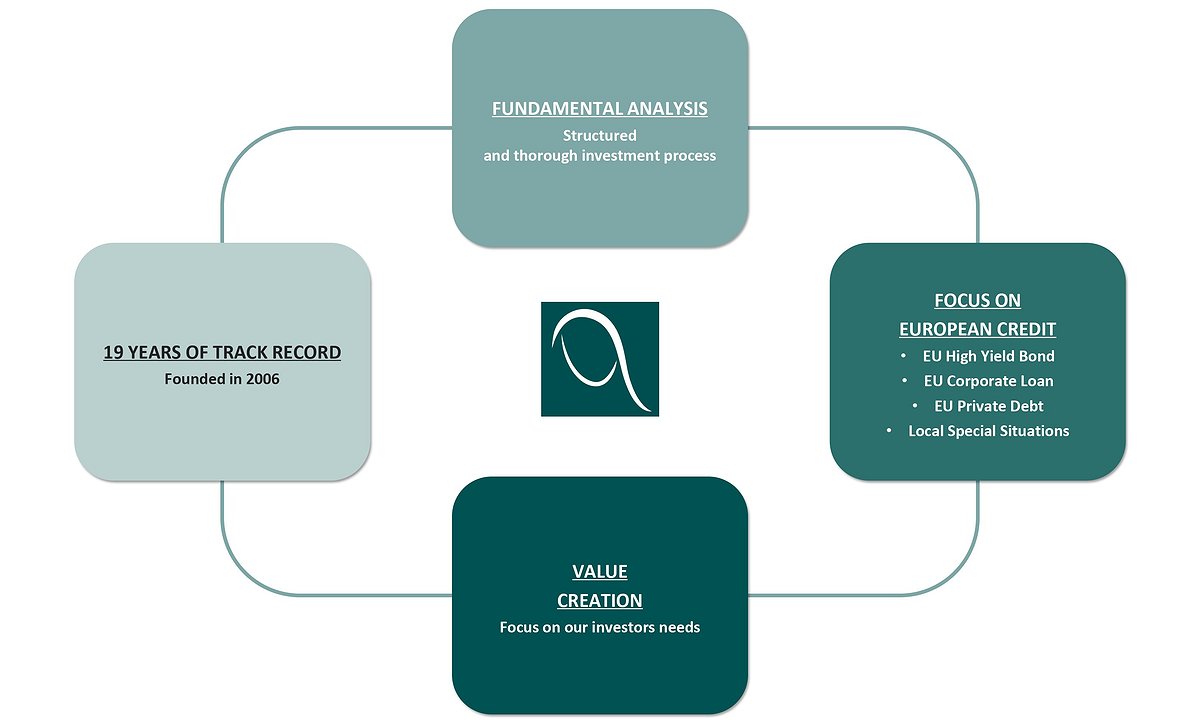

- Focus on Credit. In a world where asset management business is becoming more and more de-specilized, we believe that it is vital to be focused on specific asset classes. At Ver Capital we keep focus on credit products via a variety of funds and investment programs.

- Capabilities that make us different. The fundamental analysis processes applied to the assets in which we invest represent a significant added value that we have built up over the years and which we place at the service of our investors.

- Independence. Ver Capital is an independent management company with a wide range of institutional investors on its funds. At Ver Capital, investment decisions are based solely on objective judgment factors.

- Excellence of our Team. The Team is the beating heart of the company. At Ver Capital, we believe in the highest standards of ethics and professionalism, and we are continually seeking the best talents to maintain and improve our distinctive capabilities.

- Focus on Clients. Our investors are our principal asset. Our investment funds operate in specific areas that meet the specific needs of our investors (for example, absolute return, recurrent cash distributions and ad hoc investment classes).

Our history

| 2005 | Ver Capital is established. |

| 2006 | Closing of the first closed-ended fund, Ver Capital Mezzanine Partners (VCMP), mainly dedicated to senior and subordinated leveraged loans. |

| 2007 | Closing of a medium term credit facility for the VCMP fund. |

| 2010 | Closing of the second closed-ended fund, Ver Capital Credit Opportunity Fund (VCCOF), mainly dedicated to senior loans and high-yield bonds. Closing of a medium term credit facility for the VCCOF. |

| 2011 | Launch of Ver Capital Credit Fund, an open-ended fund UCITS IV compliant, through the Luxembourg Sicav Nextam Partners, focused on Euro denominated high yield corporate bonds. |

| 2014 | Launch of Ver Capital Credit Partners IV (VCCP IV), mainly dedicated to senior secured corporate loans and senior secured European high yield bonds. |

| 2015 |

Start of the investment activity of the VCCP IV. Closing of a medium term credit facility for the VCCP IV with one of the main global investment banks. |

| 2016 | Launch of the Ver Capital Credit Partners Italia V with the participation of relevant institutional investors such as the Fondo Italiano d’Investimento |

| 2017 | Launch of the Ver Capital High Yield Italian PIR through the Luxembourg Sicav Nextam Partners. A UCITS compliant fund that invests in Euro high yield bonds issued by Italian companies. Qualified investment for the establishment of a PIR under the Italian Law 232 of 2016 |

| 2018 |

First Closing of Ver Capital Credit Partners VI that invests in senior secured corporate loans and bonds. First NAV of Ver Capital European Corporate Selection, UCITS compliant fund that invests in non-financial high yield bonds issued by large companies from core European countries.

|

| 2019 |

Launch of the Ver Capital Credit Partners VII, with the participation of relevant institutional investors such as CDP, FEI and main insurance players. First NAV of Ver Capital Cedola 2022, UCITS compliant fund with a maturity of 3 years that invests in Euro high yield bonds. |

| 2020 |

Launch of Ver Capital Sinloc Transition Energy Fund, an Italian closed-end fund that invests in Energy Transition. Launch of Ver Capital Short Term Fund, a UCITS compliant fund that invests in non-financial high yield bonds issued by large companies from core European countries with a short maturity. First Closing of Ver Capital Credit Partners VIII that invests in senior secured corporate loans and bonds. First Closing at €225m of Ver Capital Credit Partners SMEs VII with the participation of relevant institutional investors such as CDP, FEI and main insurance players.

|

| 2021 |

Second Closing at €295m of Ver Capital Credit Partners SMEs VII. Launch of Ver Capital Eltif strategy. Launch of Ver Capital Trade Receivable fund, a Luxembourg closed-end fund that invests in European Trade Receivables.

|

| 2022 |

Third closing at € 307.8 million of Ver Capital Credit Partners SMEs VII. First closing of Ver Capital Sinloc Transition Energy Fund, an Italian closed-end fund that invests in Energy Transition. |

| 2023 |

Launch of the Ver Capital Credit Partners SMEs– Private Debt, successor of the fund Ver Capital Credit Partners SMEs VII. First closing of Ver Capital Trade Receivable fund. Launch of the Ver Capital Special Situations fund. |

| 2022 |

Third closing at € 307.8 million of Ver Capital Credit Partners SMEs VII. First closing of Ver Capital Sinloc Transition Energy Fund, an Italian closed-end fund that invests in Energy Transition. |

| 2023 |

Launch of the Ver Capital Credit Partners SMEs– Private Debt, successor of the fund Ver Capital Credit Partners SMEs VII. First closing of Ver Capital Trade Receivable fund. Launch of the Ver Capital Special Situations fund. |

| 2024 |

April 2024 Ver Capital joins Sienna Investment Managers Group. September 2024 First Closing of Ver Capital Special Situations Fund. |