July 6 - No meat for hawks

Published: July 6, 2021

“No meat for hawks”

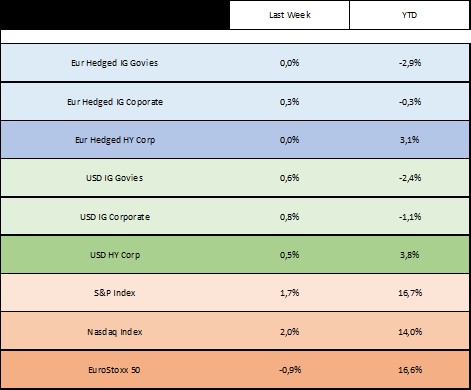

Flat week for EU HY segment while equity performed well in the US this week and poorly in the Europe (below the table). The difference lies in the higher exposure to the growth companies in the American market. After the flattening of the US yield curve, in the last few weeks, the market started to rotate back to the growth segment again.

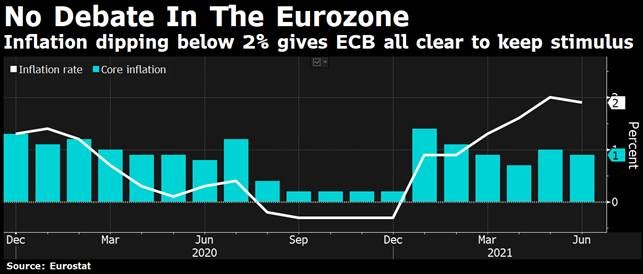

If in the US the taper topic is hot, ECB, instead, cooled down European hawks. Before the meeting of July, C. Lagarde publicly stated that it was far too early to even talk about removing stimulus, leaving no meat on the table of the hawks. A change of dialectic would threat market expectations and credibility of the bank itself.

On the Euro High Yield side the first half of the year closed positively with the index posting a +3% and a record supply, in the quarter, of a total €48.4bn issued. Overall, we remain positive on risky assets as we expect them to perform well in an context where growth is rebounding, economies are reopening and policy makers remain accommodative.