June 28 - Millenium Bug and other Stories

Published: June 28, 2021

“Millenium Bug and other Stories”

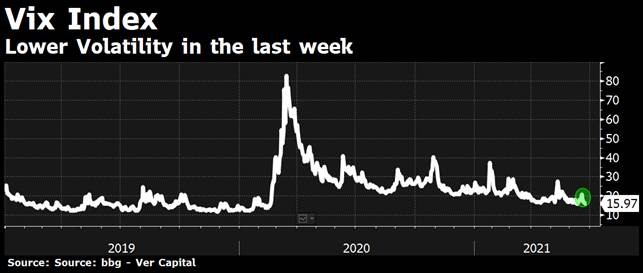

Calmer and positive week in both equity and HY markets with the S&P 2.7% and credit spreads tightening across the curve CDX HY -13Bps and CDX IG -3bps. Volatility, as shown in the graph below, is down; however, there were a couple of situations where the market seemed more nervous than the trend suggests.

The millennium bug was a real issue back then – Gen Z followers probably are googling what it is, confirming how fast time passes for the older generations – costing companies millions and making people anxious.

For example, in Scotland air traffic controllers thought their radar had failed as they could not see any aircraft. The radar was actually working perfectly, but all flights had been cancelled because of fears that planes could not work Due to the “millennium bug”.

So we can define a millenium bug where people panic with no evident/underlying data.

There were a couple of “millennium bug” stories in the market in the last couple of weeks. One is MPS whose bonds (particularly the longer subordinated ones, above an example) were hit on the uncertainties related to the future of the company. Weirdly equity did not move much while the bonds were dropping. The second one was Adler Group which both equity (below the graph representation) and bonds were beaten down on Thursday on some vague rumours coming from a short seller. The rumours where coming from an article where the short seller was maybe targeting a German company. As the Scottish air traffic controllers markets players thought they missed something big “panicking” a bit.

Anyway negative narrative quickly reversed for both names. However the market is ready to bring volatility on singular names without fundamental data … leaving juicy opportunities on the table as well.

A couple of thoughts:

- Swift downwards movement. We think most of HY PMs (especially on the European bond side) are satisfied with their returns and they don’t care to cut on singular positions

- Xover closed the week at 224. Other 4 bps of tightening and we reached the pre Covid level. A bit of volatility is understandable. The difference between the millenium bug and current market environment is the “volatility” term structure. If in the first case everyone knew when the event was about to happen, now everybody expects something in the future but not knowing when and how.

- Difference between equity and HY investors. The equity of Adler recovered the drawdown quite quickly as short sales report was not related to the company (but to an American oil one !!!!), instead the bonds lagged a bit with the recovery (depending on the maturities). We believe it is explained by the difference between bonds’ and equity’s market structure and investors’ psychology. Bond investors look more risk averse and they are more cautious to jump back on the those type of stories leaving alpha opportunities.