LOANS UPDATE - ESG NEW ROAD

Published: June 28, 2021

EOW Loans Update – ESG NEW ROAD

European Leveraged Loan Index (ELLI) has registered a slightly positive week, bringing returns to +0.02% (+0.03% excluding currency effect) in the fourth week of June, while year to date return reached +3.24% (+3.00% excluding currency effect). July pipeline is expected to be strong with different M&A and refinancing deals coming into the market before the summer break.

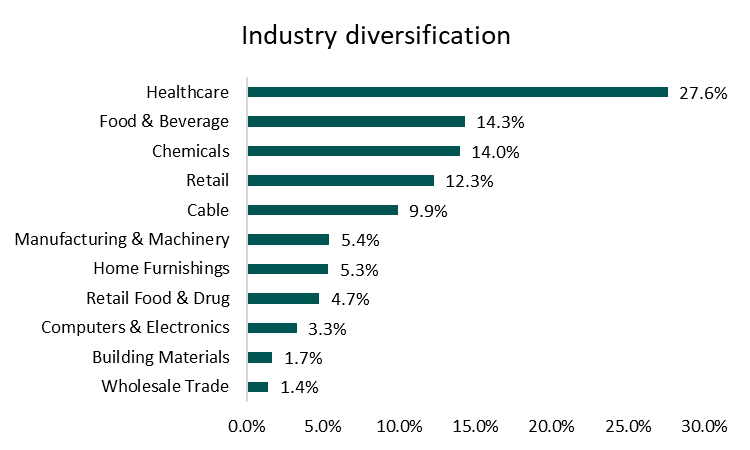

Environmental, social and governance factors are entering in the European leverage loans market, June 2021 YTD issuance are approximately €16 bn. There is a strong diversification, as shown in the below chart, between sectors that make use of sustainability-linked issuances.

The sustainability-linked issuances are used for different purpose such as LBO (38%), refinancing (38%) or dividend distribution (14%). It is common knowledge that many issuers do not have the sufficient capital expenditure allocated to sustainability projects to issue green debt, but they are still able to include sustainability-linked structures in the issuances, such as pricing ratchets or coupon step-ups linked to company-specific ESG factors. In this way ESG factors will reach also smaller firms or companies that are about to implement sustainability rules.

2021 will be the turn point year in terms of ESG commitment in the leverage loan market, not only for companies that would issue new debt but also for investment manager who see ESG factors becoming more and more part of investor requests.